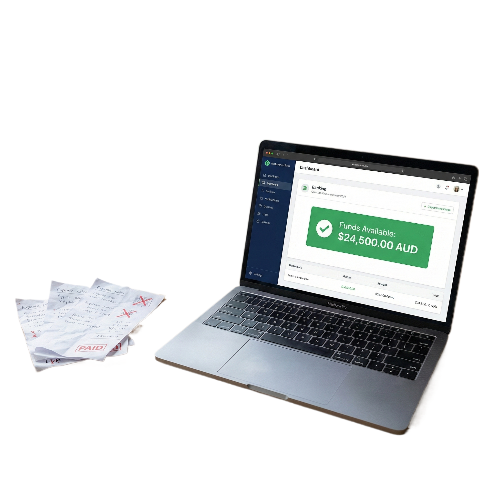

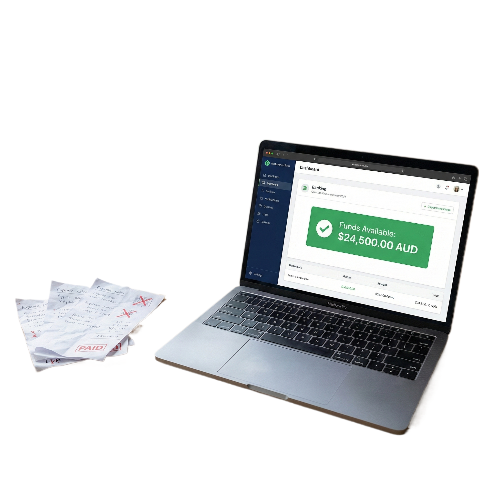

Business Overdraft & Line of Credit Loan

Smart Asset Lending gives you borrowing flexibility to manage day-to-day expenses and unexpected costs.

Google Ratings

Business Overdraft & Line of Credit Loan

Smart Asset Lending gives you borrowing flexibility to manage day-to-day expenses and unexpected costs.

Google Ratings

Keep Cash Flow Under Control

>> Pay interest only on what you use

>> Ideal for short-term operational needs

>> Flexible limits that can grow with your business

Calculate Your Monthly Repayment Amount

Why Smart Asset Lending Overdraft Solutions Work

Ongoing access to funds without reapplying.

Flexible repayment terms to suit your operations.

Who This Business Overdraft or Line of Credit Is Perfect For

Businesses Managing Seasonal Cash Flow

Businesses with Slow-Paying Clients

Growing Businesses Needing Flexible Access to Funds

Businesses Managing Seasonal Cash Flow

Ideal for companies that experience income fluctuations or off-peak periods.

Businesses with Slow-Paying Clients

Growing Businesses Needing Flexible Access to Funds

Stay Cash-Ready in 4 Simple Steps

Apply Online in Minutes

Set Your Credit Limit

We help determine a borrowing limit that suits your cash flow needs.

Get Fast Approval

Access Funds Anytime

Apply Online in Minutes

Submit a quick application with basic business details.

Set Your Credit Limit

Get Fast Approval

Access Funds Anytime

Eligibility

Valid ABN

Minimum Trading History

Proof of Business Income

Australian Residency

Clear Business Purpose

Credit Profile

Our Clients Speak for Us

"Best Rates & Fast Approvals"

Smart Asset Lending made my vehicle finance so simple. I had approval within days and the rate was ..."Excellent Servcies"

The team understood my business needs and secured the right equipment loan without the stress. I highly recommend it!"Flexible Repayment Options"

As a small business owner, I needed a loan for new equipment. Smart Asset Lending worked closely with me to create a flexible ..."Best Quality Services"

Smart Asset Lending made securing my vehicle finance completely stress-free. The team understood exactly what I needed, provided clear guidance, and I had ...

Quick Assist

What is a business overdraft?

How is interest calculated?

Can I use the overdraft for short-term cash flow?

What is the difference between a line of credit loans and an overdraft?

Can I renew my overdraft limit annually?

Flexible Borrowing for Your Business Needs

Services

Services

Contact Us

C5 Level 1, 2 Main Street, Point Cook, VIC 3030

0435 393 623 | 03 70652000

Queensland:

38-44 Lissner St, Toowong, QLD 4066

0478 886 007

18 Dublin Ave, Spring Mountain QLD 4300

0430 856 799

Disclaimer statement : This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances, and your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice, and you should always seek professional advice in relation to your individual circumstances. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply.